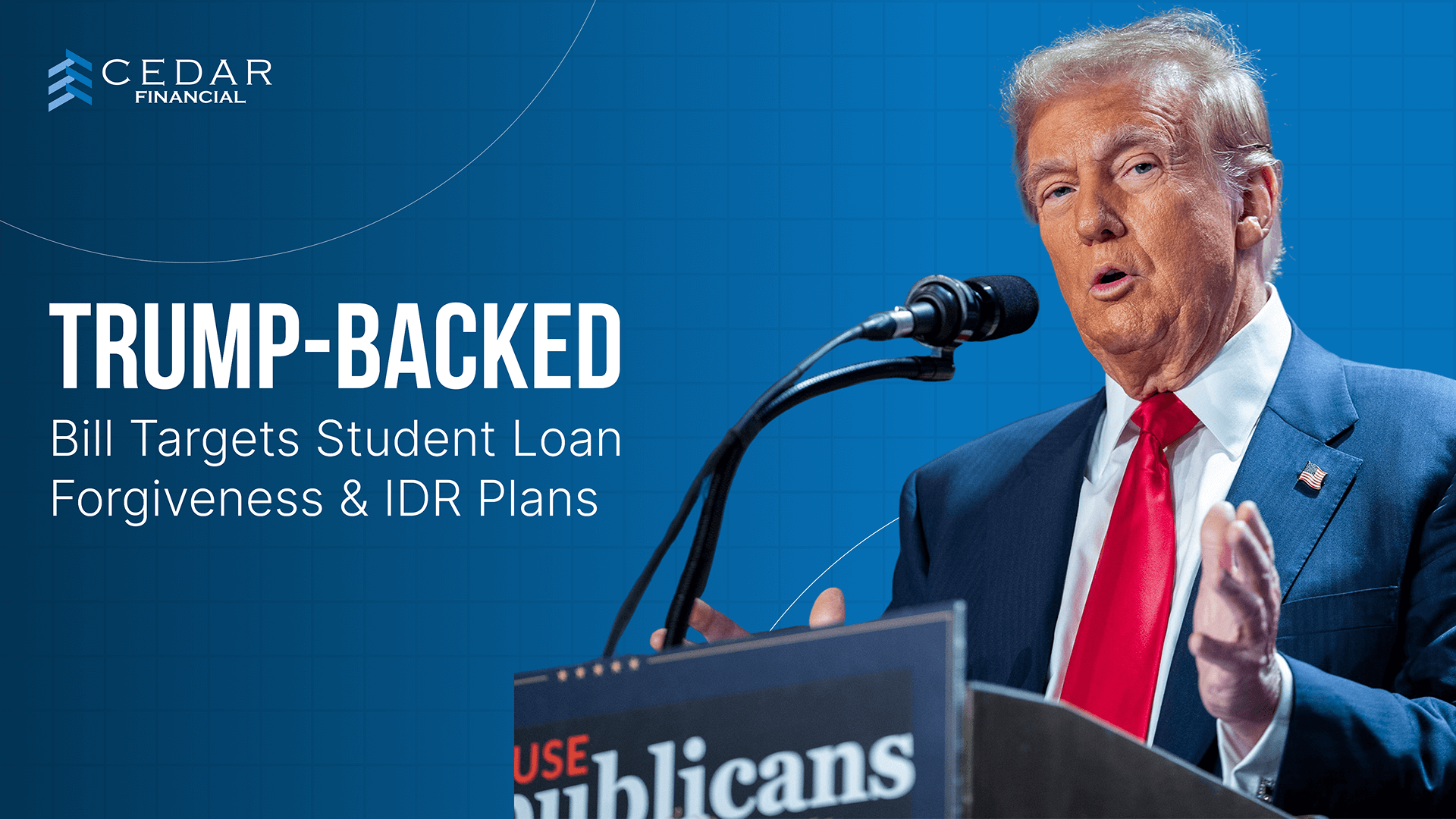

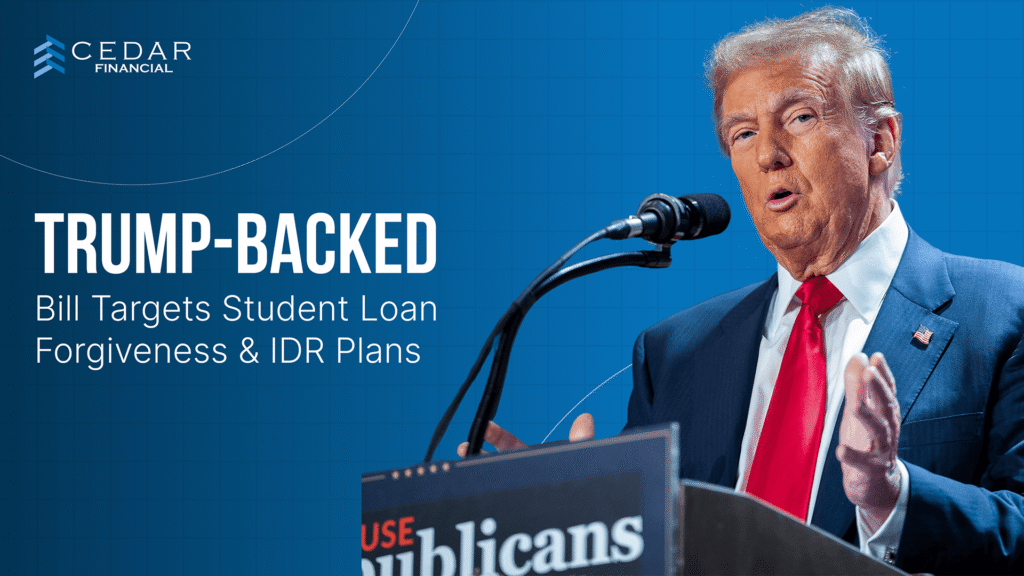

A Republican-backed tax and spending bill, endorsed by former President Donald Trump, is taking direct aim at President Biden’s student loan relief efforts. The proposal would overhaul key federal loan programs – signaling a significant shift in the future of student loan forgiveness plans.

Here’s the full breakdown:

Implementation Timeline

All changes apply to new federal student loans disbursed on or after July 1, 2026.

Existing loans will not be affected retroactively, but anyone borrowing after that date enters an entirely different system.

Repayment Plans: Streamlined, But Stretching Longer

Federal repayment plans like SAVE, PAYE, REPAYE, and IBR will be phased out for new borrowers.

They’ll be replaced with just two options:

- A Standard Plan with fixed monthly payments, based on the total debt size.

- A Repayment Assistance Plan (RAP), which is income-driven and starts at just $10/month – offering forgiveness only after 30 years.

Though simpler, the new setup may be more expensive in the long term. Analysts estimate the average borrower will pay around $3,000 more per year under RAP compared to current plans like SAVE.

Lifetime Federal Debt Limits (First-Ever Caps)

For the first time, borrowers will face hard limits on how much they can borrow from the federal government:

- Graduate students can borrow up to $20,500 per year, with a maximum of $100,000 total.

- Professional students in fields like law or medicine can borrow up to $50,000 per year, capped at $200,000 total.

- Parent PLUS loans will be capped at $65,000 per student.

- The overall federal borrowing limit (excluding Parent PLUS) is $200,000.

Previously, students could borrow up to the full cost of attendance. Now, many will need to turn to private lenders or scale back educational plans, especially for advanced degrees.

Loan Types Being Eliminated

Several widely used federal loan options will be discontinued for future borrowers:

- Subsidized loans for undergraduates will no longer be available

- Graduate PLUS loans are being phased out

- Parent PLUS loans remain, but are now capped at $65,000

These eliminations reduce borrowing flexibility and are expected to increase reliance on private loans significantly.

Deferments and Forbearance: Reduced Safety Nets

- Deferments for unemployment or economic hardship will be eliminated.

- Forbearance is limited to 9 months within any 24-month period.

Without these protections, borrowers may face a higher risk of delinquency during financial setbacks.

Pell Grant Eligibility Tightened

Pell Grants will now only be available to students taking at least 15 credit hours per semester.

Need-based aid will be tied to the national median program cost, rather than individual school tuition – cutting down on aid for students attending higher-cost institutions. Part-time and nontraditional students will be especially impacted.

Institutional Accountability: Schools Under Pressure

Colleges with high rates of loan non-repayment could lose access to federal loan programs entirely.

Meanwhile, the Public Service Loan Forgiveness (PSLF) program will now exclude specific nonprofits deemed to serve a “substantial illegal purpose” – a vague definition that has raised concerns among public service employers.

What It All Means

This legislation simplifies federal lending – but also limits access, reduces safety nets, and extends repayment timelines.

It shifts more risk and responsibility to individual borrowers and makes private financing more central to higher education planning.

Expect ripple effects in:

- Enrollment trends

- Student borrowing behavior

- Institutional aid policies

- Private loan market growth

Bottom Line

This overhaul reshapes how Americans borrow, repay, and access higher education. It cuts federal support, extends debt timelines, and increases reliance on private financing.

In short, the federal student loan system is about to change dramatically. So, if you’re in education, finance, lending, or collections – now’s the time to prepare.