The long-term health of your credit union and the quality of your relationships with members depend on your ability to collect past-due accounts.

Whether you are just getting into credit union debt collection or are an already established entity that wants to explore how they can improve cash flow and collect past due accounts while still maintaining a high member satisfaction rate – this is the read for you.

In this comprehensive guide, you’ll be able to learn the ins and outs of credit union debt collection, including the best practices, resources, and strategies for balancing member retention with efficient recovery methodologies.

What is Credit Union Debt Collection?

The terminology credit union debt collection refers to the procedure by which your credit union retrieves money from members who have neglected to fulfill their loan commitments.

Unlike banks, credit unions serve their members instead of the general public and also work as a non-profit organization.

What is the difference between the two? We’ll take a closer look later down the line, but for now, we can say that credit unions have:

- Lower fees and interest rates

- Member centric approach

- A focus on community building

Your credit union, in keeping with this member-first philosophy, should aim to recoup past-due payments while still fostering a friendly and helpful rapport with its members.

Why Is Debt Collection Important to Credit Unions?

- Maintaining Financial Stability: Effective debt collection guarantees that all members continue to get affordable loans and services.

- Member Equity Protection: Recovering outstanding debts protects members’ shares and assets.

- Long-Term Sustainability: A well-managed collection procedure reduces operational pressure and reputational hazards associated with unsettled debt.

Seven Types of Debt Credit Unions Offer & Collect

Credit unions typically do both, offering and collecting a variety of debts, similar to banks, but with a focus on their member-centric mission.

Despite having a member-centric approach, not everything goes as planned, and sometimes delinquency levels see a surge, which is why many credit unions will find themselves stuck between a rock and a hard place.

Here’s a breakdown of the types of debt credit unions collect and the intensity of measures they can possibly take:

1. Auto Loans

Vehicle or Auto loans tend to be one of the most common loan types for credit unions.

Credit unions play a significant role in auto loan financing and are also responsible for collecting delinquent vehicle loans, which can include repossession when payments are not made.

As of 2024, credit unions made up approximately 23.66% of the U.S. auto loan market.

2. Personal Loans

Depending on a borrower’s creditworthiness, credit unions commonly provide unsecured personal loans.

If everything is going as expected, the internal collections staff usually handles these loans. However, if a credit union struggles to collect such loans, outsourcing them to a collection agency becomes a viable option.

3. Credit Cards

Credit union credit cards offer flexible access to funds but can result in delinquency if payments are missed. In such cases, the account of a member can go into delinquency and eventually be charged off if unresolved.

However, as we all know that credit unions are super community-focused and tend to be more forgiving, this leads to them offering options such as payment plans or temporary hardship programs to avoid severe consequences.

This member-first approach helps prevent long-term financial strain for cardholders.

4. Home Equity Loans and HELOCs

Credit unions provide home equity loans and Home Equity Lines of Credit (HELOCs) at significantly lower interest rates compared to bank loans.

Credit union members can enjoy these low interest rates as long as they fulfill their end of the deal – that is, complying with the union’s terms, conditions, and repayment obligations, including timely payments and maintaining good standing with the credit union.

However, when payments are missed, credit unions hold full authority over placing a lien or pursuing legal action to recover the debt, although foreclosure is typically a last resort as it can affect their member relations and their very foundation.

Credit unions prioritize alternatives such as loan modifications or repayment plans before taking such drastic steps. This reflects their commitment to protecting the member’s home and financial stability.

Did you know?

By Q4 2024, credit union delinquency rates rose to 0.69%, up from 0.61% in Q4 2023.

5. Mortgages

While not all credit unions offer mortgages, those that do verily understand the importance of retaining homeownership for members.

However, if a mortgage goes into default, credit unions often explore solutions like loan modifications, forbearance, or refinancing.

It’s essential to notice that foreclosure is generally avoided as a credit union debt collection strategy unless absolutely necessary, as credit unions aim to balance financial recovery while preserving member relationships and community stability.

6. Overdrafts and Checking Accounts

Overdrafts and unpaid fees can lead to negative account balances, which credit unions treat as consumer debt.

While these balances are pursued for repayment, credit unions often work with members to resolve the issue without severe penalties. The focus is on restoring account health, and credit unions are more likely to offer flexible solutions compared to larger banks.

7. Private Student Loans

Some credit unions offer private student loans, which can lead to collection efforts if borrowers default.

While recovery is a priority, credit unions often take a more understanding approach by offering repayment options or temporary forbearance.

Their goal is to help members avoid long-term financial consequences while ensuring the loan is repaid.

How Do Credit Unions Collect Debt?

Credit unions employ a structured yet empathetic approach to debt collection, typically following these key stages:

1. Delinquency Notices

The collection process begins with timely delinquency notices sent to members. These communications start as gentle reminders and gradually increase in urgency if the account remains unpaid.

Early outreach is crucial as it:

- Alerts members to potential issues before they escalate

- Provides immediate opportunities to address the delinquency

- Establishes a documented history of collection attempts

2. Payment Plans

Credit unions distinguish themselves by offering customized payment arrangements for struggling members.

These solutions may include:

- Modified payment schedules that align with the member’s cash flow

- Temporarily reduced payment amounts during financial hardship

- Extended repayment timelines to lower monthly obligations

- Hardship programs for qualifying circumstances

By creating flexible solutions, credit unions demonstrate their commitment to working with members through financial difficulties rather than immediately pursuing aggressive collection tactics.

3. Direct Member Communication

Throughout the collection process, maintaining consistent, supportive communication is essential.

Credit unions typically:

- Use multiple channels (phone, email, letter, in-person) to reach members

- Train staff to approach collections conversations with empathy

- Focus on problem-solving rather than punitive messaging

- Provide financial education resources alongside collection notices

Credit Union Debt Recovery Process: Stages and Best Practices

Effective debt recovery requires a systematic approach that balances efficiency with member service.

The typical credit union debt recovery process includes the following:

1. Early Reminders

When payments first become delinquent (typically 1-15 days past due), credit unions initiate friendly reminders through:

- Automated payment reminders via text or email

- Personalized phone calls from member service representatives

- Letters explaining the missed payment and providing payment options

- Online banking alerts notifying members of past-due status

This early intervention often resolves many delinquencies before they require more serious collection efforts.

2. Charge-Offs

If debt remains unpaid beyond a specific timeframe (typically 180 days for most loan types), credit unions may need to charge off the debt, meaning:

- The loan is removed from the credit union’s active accounts receivable

- The debt is recorded as a loss for accounting and regulatory purposes

- Collection efforts continue despite the accounting adjustment

- Recovery strategies may intensify or shift to specialized collection teams

Credit unions remain transparent with members during this phase, clearly explaining what a charge-off means for their account and credit standing.

3. Collections

For persistently delinquent accounts, credit unions must escalate to more intensive collection efforts:

- Formal demand letters outlining legal obligations and consequences

- Potential repossession of collateral for secured loans

- Possible legal action if other recovery attempts fail

- Consideration of third-party collection assistance

Many credit unions prefer handling collections in-house whenever possible to maintain control over member interactions and preserve relationships, even during difficult financial circumstances.

The Role of NCUA in Credit Union Debt Collection

The National Credit Union Administration (NCUA) provides critical oversight of credit union debt collection practices to ensure fair treatment of members and institutional safety.

Key NCUA Guidelines:

- Fair Debt Collection Compliance: Credit unions must adhere to the Fair Debt Collection Practices Act (FDCPA) regulations, even when collecting their own debt.

- Member Protection Standards: NCUA examinations verify that collection practices protect members’ rights throughout the recovery process.

- Transparency Requirements: Credit unions must maintain clear communication about debt obligations, dispute processes, and collection procedures.

- Collection Documentation: NCUA expects credit unions to maintain comprehensive records of all collection activities and member communications.

Credit unions that fail to comply with these standards face regulatory consequences, including possible enforcement actions.

Credit Union Debt Collection Laws

Credit unions must navigate a complex legal landscape when collecting debt, including:

- Fair Debt Collection Practices Act (FDCPA): Prohibits abusive, deceptive, or unfair collection practices

- Consumer Financial Protection Bureau (CFPB) regulations: Additional federal oversight of consumer financial services

- State-specific collection laws: Varying requirements that may be more restrictive than federal regulations

- Telephone Consumer Protection Act (TCPA): Rules governing automated calls and messages

- Bankruptcy laws: Procedures for handling accounts in bankruptcy protection

Compliance with these regulations protects both the credit union and its members from improper collection practices.

Balancing Debt Collection and Member Retention

The unique challenge for credit unions lies in recovering funds while preserving valuable member relationships. Successful member-centric strategies include:

1. Flexible Payment Terms

When members face legitimate financial difficulties, credit unions can offer:

- Loan modifications that permanently change terms to improve affordability

- Forbearance agreements that temporarily suspend or reduce payments

- Debt consolidation options that simplify repayment of multiple obligations

- Principal reduction in certain hardship situations

These accommodations demonstrate the credit union’s commitment to finding mutually beneficial solutions.

2. Financial Counseling

Many credit unions provide educational resources to help members improve their financial situation:

- Free budgeting assistance to address cash flow challenges

- Credit counseling services to develop debt management plans

- Financial literacy workshops focused on money management skills

- Referrals to community assistance programs when appropriate

By addressing the root causes of delinquency, credit unions help members avoid future financial difficulties.

3. Clear Communication

Transparent, empathetic communication throughout the collection process:

- Clearly explains options available to members facing hardship

- Avoids intimidating language or threatening tactics

- Provides straightforward information about the consequences of non-payment

- Maintains a supportive tone that emphasizes problem-solving

Ethical Debt Collection Practices for Credit Unions

Credit unions distinguish themselves through ethical collection approaches:

- Respectful interactions: Treating members with dignity regardless of their financial circumstances

- Consistent procedures: Applying collection policies fairly across all membership

- Honest communication: Providing accurate information about debts, options, and consequences

- Appropriate escalation: Using increasingly severe collection measures only when necessary

- Privacy protection: Safeguarding sensitive financial information throughout the collection process

These ethical standards align with credit unions’ cooperative principles while facilitating effective recovery.

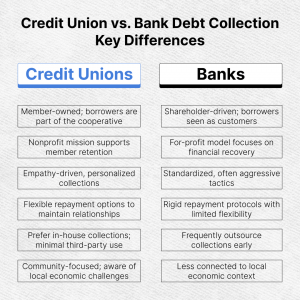

Credit Union vs. Bank Debt Collection: Key Differences

Understanding the fundamental differences between credit union and bank collection practices helps members appreciate the credit union advantage:

Credit Unions:

- Member Ownership: As cooperative institutions, credit unions view delinquent borrowers as owners rather than simply customers, leading to more personalized collection approaches.

- Community Focus: Local ties often mean credit unions have a deeper understanding of regional economic challenges affecting members.

- Non-profit Mission: Without shareholder profit pressure, credit unions can prioritize member retention alongside recovery goals.

- Relationship Emphasis: Credit unions typically value long-term relationships over immediate recovery, allowing greater flexibility.

Banks:

- Shareholder-Driven: Commercial banks’ primary responsibility to shareholders often results in more aggressive collection tactics.

- Standardized Processes: Banks typically have less flexibility to deviate from established collection protocols.

- Profit-Center Model: Collection departments in banks may be evaluated on recovery metrics rather than customer retention.

- More Frequent Outsourcing: Banks more commonly transfer delinquent accounts to third-party agencies earlier in the process.

Understanding Member Rights During Debt Collection

Credit unions must respect and protect members’ legal rights throughout the collection process:

Key Member Rights:

- Right to Dispute: Members can challenge the validity of a debt or question the amount owed.

- Right to Validation: Members can request verification that the debt is legitimate and accurately calculated.

- Right to Privacy: Collection communications must respect confidentiality and avoid disclosure to third parties.

- Right to Fair Treatment: Members are protected from harassment, threats, or deceptive practices.

- Right to Cease Communication: Members can request that certain types of collection contact be discontinued.

Credit unions that respect these rights build trust even during challenging collection situations.

Impact of Unpaid Debt on Credit Unions

Understanding the consequences of uncollected debt helps explain why recovery efforts are necessary:

- Financial Losses: Directly impact the credit union’s bottom line and available capital

- Increased Costs: May require additional staffing and resources for collection efforts

- Regulatory Concerns: Excessive delinquency can trigger increased regulatory scrutiny

- Rate Implications: May lead to higher interest rates for all borrowers to offset losses

- Service Limitations: Can restrict the credit union’s ability to develop new products or services

By effectively managing collections, credit unions protect their ability to serve the entire membership.

💡 Tip

Always prioritize open communication with members. Early outreach – before accounts become severely delinquent – can lead to collaborative repayment solutions and stronger long-term relationships.

Credit Union Debt Collection Glossary

Understanding key terminology helps members navigate the collection process:

Charge-off

Definition:

The accounting process of removing a delinquent loan from accounts receivable, typically after 120–180 days of non-payment.

What it Means for Members:

While the credit union no longer considers the loan an asset, the debt still exists and can be pursued through collections or third-party agencies. Charge-offs negatively impact credit scores.

Skip-tracing

Definition:

The process of locating members who have moved or changed contact information without notifying the credit union.

What it Means for Members:

If you’re unreachable, collection efforts may include professional tools or agencies to find your updated contact details. This can delay resolution and increase stress.

Forbearance

Definition:

A temporary pause or reduction in loan payments, typically due to financial hardship.

What it Means for Members:

Forbearance can provide breathing room, but interest may continue to accrue. It’s essential to understand the terms and resume regular payments as agreed to avoid default.

Default

Definition:

The failure to meet legal loan repayment obligations, such as missed payments beyond a set period.

What it Means for Members:

Defaulting can lead to serious financial consequences, including credit damage, legal action, or repossession of assets.

Repossession

Definition:

The act of reclaiming property used as collateral on a delinquent loan, such as a vehicle.

What it Means for Members:

Repossession can occur without court approval, depending on the contract. This severely impacts credit and may still leave a balance owed if the asset sells for less than the loan.

Lien

Definition:

A legal claim against a member’s property as security for unpaid debt.

What it Means for Members:

A lien can prevent the sale or refinancing of the assets (e.g., car or home) until the debt is paid, affecting financial flexibility.

Garnishment

Definition:

A court-ordered method of collecting debt by deducting wages or bank account funds.

What it Means for Members:

If a judgment is obtained, a portion of your paycheck or assets can be legally withheld. This often comes after repeated failure to resolve the debt voluntarily.

Statute of Limitations

Definition:

The time frame in which a creditor can legally sue to collect a debt, which varies by state and type of loan.

What it Means for Members:

Once expired, creditors can’t sue – but they may still attempt to collect. Making a payment may restart the clock, so it’s vital to understand your rights.

Outsourcing Credit Union Debt Collection

While many credit unions prefer handling collections internally, circumstances sometimes warrant partnering with external agencies:

When to Consider Outsourcing:

- For accounts requiring specialized recovery expertise

- When internal resources are insufficient for collection volume

- For skip-tracing and locating members who cannot be reached

- In cases requiring legal expertise beyond internal capabilities

Best Practices for Outsourcing:

- Select agencies that understand and respect the credit union philosophy

- Establish clear communication protocols and service-level agreements

- Maintain oversight of all third-party collection activities

- Ensure compliance with all applicable regulations

Conclusion: Maximizing Debt Recovery While Preserving Relationships

Effective credit union debt collection balances fiscal responsibility with the member-first principles that define the credit union difference.

By implementing ethical collection practices, offering flexible solutions, and leveraging appropriate tools, credit unions can successfully recover funds while maintaining the trust and loyalty that distinguishes them from other financial institutions.

The most successful collection approaches recognize that today’s delinquent borrower may become tomorrow’s loyal member when treated with respect and understanding during financial difficulties. See how Cedar Financial’s people-first approach tackles credit union debt recovery with empathy.

This long-term perspective on member relationships represents the true credit union advantage in debt collection.