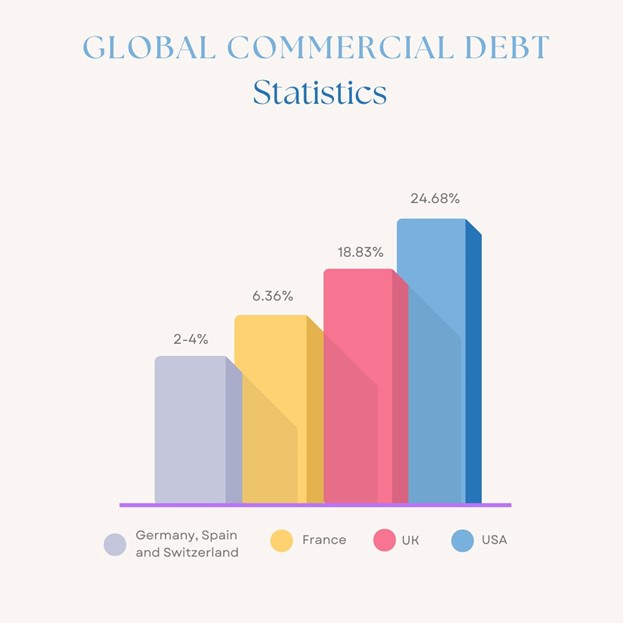

Businesses worldwide have set their sights on boosting their revenue through accounts receivable. This is done to ensure the commercial sector does not get hit with the ever-growing size of the worldwide debt market. While socioeconomic factors affect how debt recovery behaves in multiple industries, commercial debt collection can be enhanced by overseeing the market analysis and the trends occurring in the commercial debt sector.

Recent advancements in artificial intelligence (AI) have revamped multiple industries over a short period, especially for debt recovery agencies. Instead of solely relying on manual operational efforts for all debt collection-related queries, collection agencies worldwide have started to adopt AI and its machine learning capabilities.

One of the biggest takeaways that debt recovery agencies have taken from AI recently is the implementation of automation in their recovery processes. This has led to better resource allocation and optimized task delegation, enabling businesses to automate repetitive tasks and focus on more ongoing matters. Some areas where businesses have seen massive improvements in their operational workflow for better cash flow are as follows:

Big Data has been on the rise for the past couple of years, and rightfully so. Businesses rely heavily on analytics and data metrics to help them reach their debt recovery benchmarks, leading to the birth of Data-Driven Decision-Making (DDDM) in commercial debt collection.

When it comes to B2B debt recovery, a large portion of resources was spent on ensuring that business debt collection remained optimal without any significant disruptions; this involved keeping track of a large number of debts while simultaneously guaranteeing the debt recovery process remained successful.

Instead of manually selecting the debts based on their current value and delinquency age, AI does the job by grouping up the business debt based on the metrics provided for a more enhanced debt recovery experience. This helps in categorizing the accounts receivable and allows businesses to focus on b2b debt recovery that involves higher-value accounts. Such segmentation also provides better communication streams for the collectors as they can concentrate better on collecting debt recovery accounts that have more priority.

Businesses spend tens of thousands of dollars on their Research and Development (R&D) departments for debt recovery to develop solutions that can reduce costs without sacrificing functionality efficiency. In the case of business debt collection, automation helps mitigate the cost by automating most of the manual tasks that were once done through resource allocation and physical workforces.

Rather than spending countless hours chasing down debts and accounts receivables to formulate debt recovery reports, AI has allowed businesses to monitor and track their commercial debts with real-time insights and analytics to ensure optimal performance in debt recovery.

The commercial world has seen a shift in its various dynamics, especially after the pandemic. This highlighted a significant aspect of debt recovery that revolved around the worldwide socioeconomic factors faced by industries.

Such socioeconomic factors affect business debt collection economically and are based on country-specific challenges and political decisions. For instance, high inflation potentially causes businesses to take more loans, which, in turn, increases the debt recovery processes made by the debtors.

Market expansion, regulation compliance, consumer behavior, and global economic cycles are just some of the socioeconomic factors that can affect debt recovery on a much larger scale, especially in the case of B2B debt recovery.

There was a time when debt collectors were infamous for their regular calls to debtors seeking debt recovery. In the modern age, however, businesses have started integrating omnichannel communications into their debt recovery process. Omnichannel communications involve the seamless integration of multiple communication platforms that work in sync to provide a better user experience to consumers.

Communications are a big part of the debt recovery process since most integral processes involve consumer decisions ranging from clearing up unpaid invoices on time to deciding on the negotiations and settlement terms for business debt collection. Therefore, by initiating omnichannel communications, businesses can maintain consistency across multiple platforms while having the ability to provide proactive debt recovery solutions to consumers.

Although widely known debt regulations such as the Fair Debt Collection Practices Act (FDCPA) usually deal with consumer debt recovery, many state laws and ethical codes regulate financial transactions between businesses and the b2b debt recovery procedures between them.

For instance, the uniform commercial code (UCC) is a state law that provides a legal basis for businesses to obtain loans on a collateral basis. When established and implemented, such regulations significantly impact global commercial debt recovery. In the past few years, companies have mainly focused on regulation compliance to ensure their b2b debt recovery abides by all laws and regulations.

Digital payments have certainly provided ease of reliability regarding debt recovery. Such e-payments offer faster and more secure payment transactions through online dispute resolution and traceable audit trails. Managing digital payments in business debt collection requires extra attention on board as it has made matters more complicated regarding the monetary aspects. Yet the added functionality it provides compared to the previously used legacy system has allowed digital payments to become the next main thing in debt recovery.

The market for debt collection agencies is expected to reach an evaluation of $39.4 billion by the end of 2033. This shows that outsourcing to collection agencies is on the road to becoming the new norm in the coming years.

The reason for such popularity in the b2b debt recovery sector is the expertise and relevant skill set these collection agencies bring to debt recovery. Collaboration with debt collection agencies reduces the in-house resources spent and enhances recovery rates by implementing a wide range of metrics and tools that are vital for debt recovery.

Instead of focusing on the available plans and debt recovery solutions, businesses are now shifting towards a more flexible approach, which involves developing proactive solutions for business debt recovery that are custom-tailored according to the needs and requirements of the users and the situations at hand.

Such user-centric custom solutions are made specifically with the users’ requirements in mind, increasing recovery rates and reducing any possible delays in the recovery process. Such custom-tailored debt recovery solutions help optimize recovery rates better by providing a debt-centric approach that adds user personalization to the business debt collection process and ensures positive relations between parties involved in debt recovery.

Regarding global debt collection, the probability of debt recovery being impacted by external and internal factors is always uncertain. Therefore, businesses have started implementing risk assessments into their debt collection to have readily available solutions in case uncertainty arises.

Proper risk assessment ensures stability in economic volatility and consumer protection in light of the various debt collection regulations. Such risk assessments in debt recovery include predictive analysis, creditworthiness assessment, the financial history of the businesses involved, as well as foreign exchange risks to ensure optimal cash flow without any constraints.